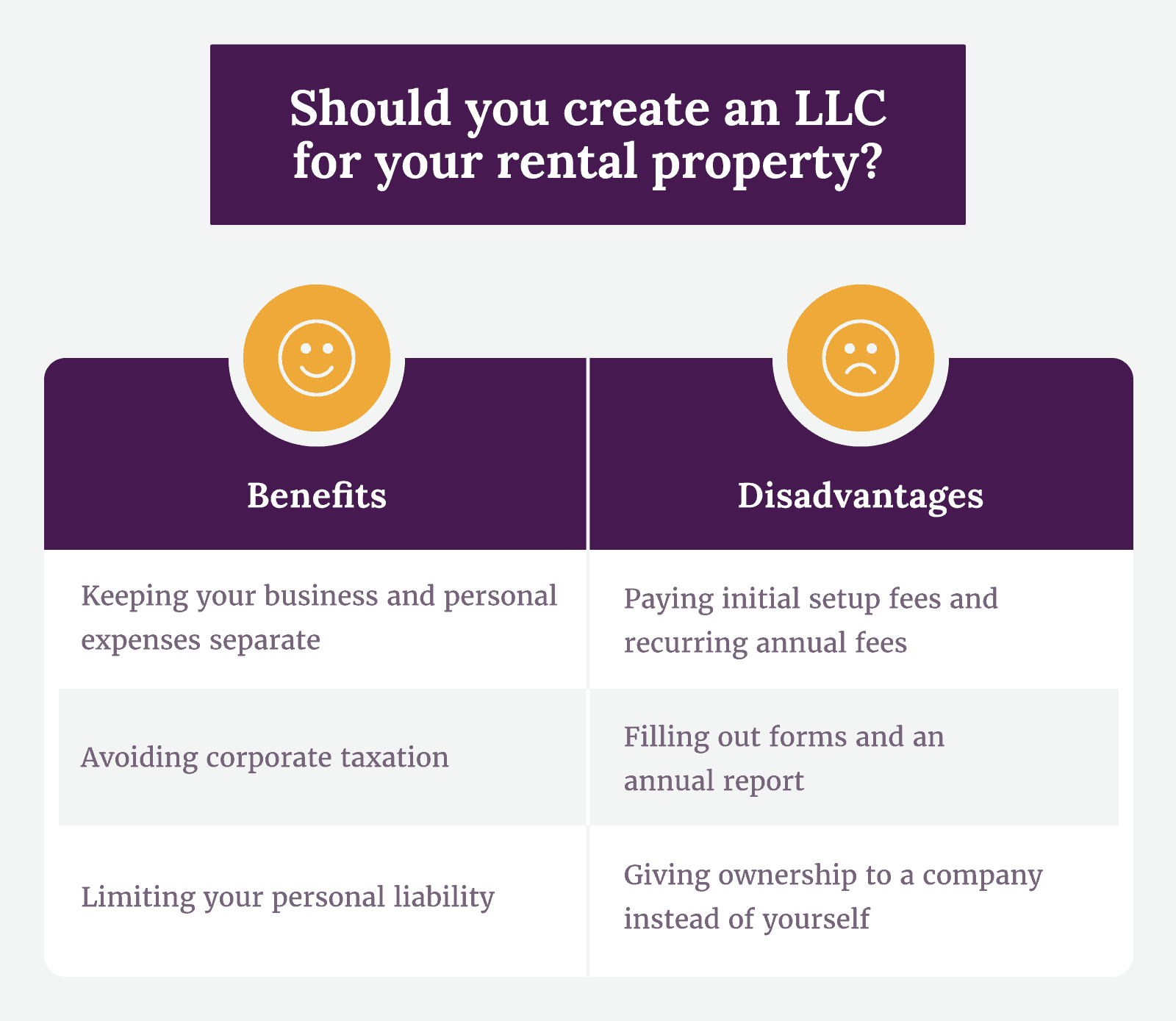

advantages and disadvantages of llc for rental property

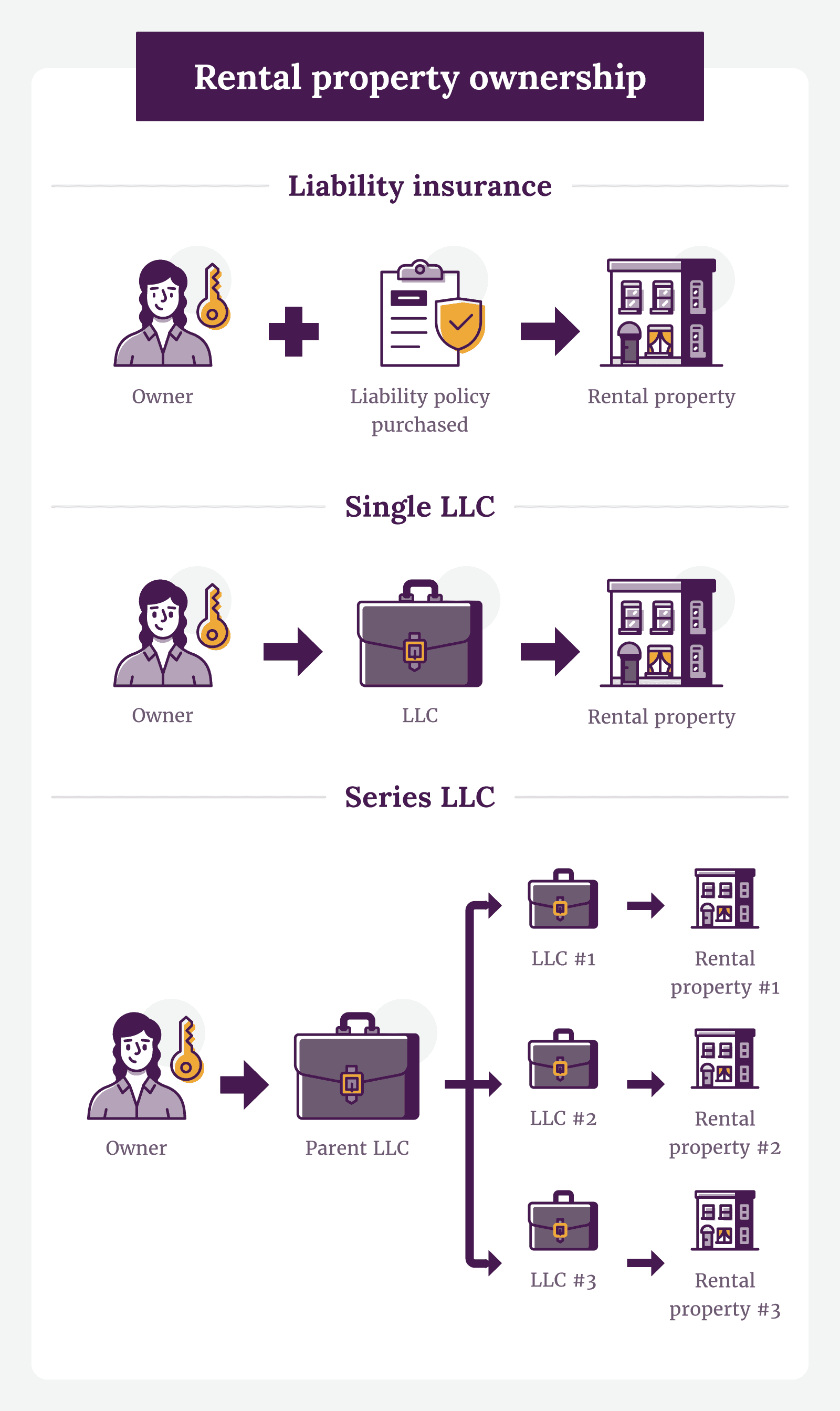

LLCs protect you from liability claims. One person can create one or multiple property owners can become members of.

23 Pros And Cons Of Using Llc For A Rental Property Brandongaille Com

Creating an LLC for your rental property is a smart choice as a property owner.

. Buying a rental property as an LLC often requires more in fees a higher down payment and operating expenses. If you are planning on financing the rental property you may not have to spend as much money upfront if you are an individual buyer rather than an LLC. Some of these benefits include.

There is a fee to create an LLC and most states charge an annual registration fee. Pass-through tax advantages. The drawbacks of having rental properties include a lack of liquidity the cost of upkeep and the potential for difficult tenants and for the neighborhoods appeal to decline.

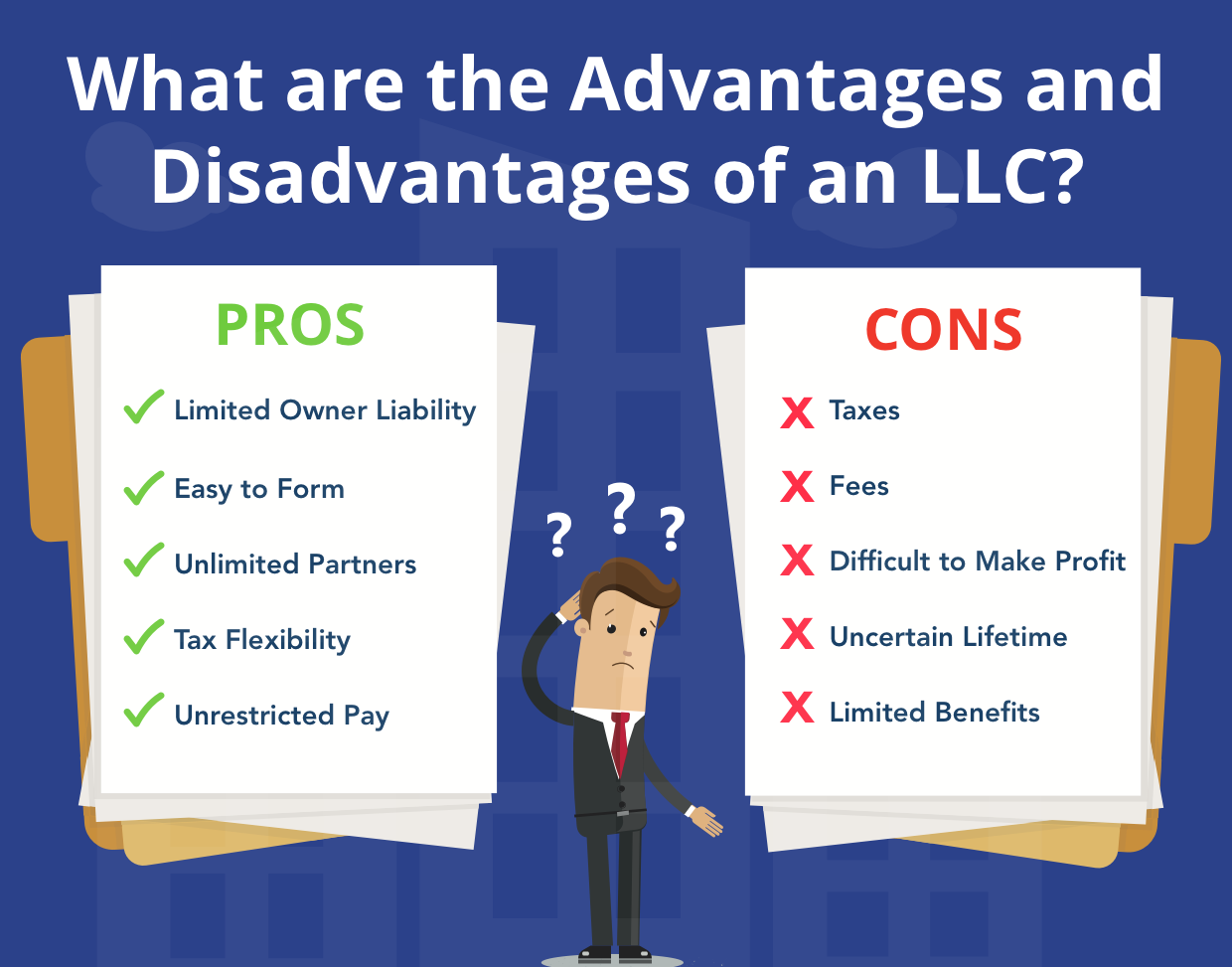

Most traditional residential loans and mortgages for rental. Benefits Of An LLC Limited Liability Company Forming An LLC. Some of the benefits of an LLC include personal liability protection tax flexibility their easy startup process less compliance paperworkmanagement flexibility distribution flexibility few ownership restrictions charging orders and the credibility they can give a business.

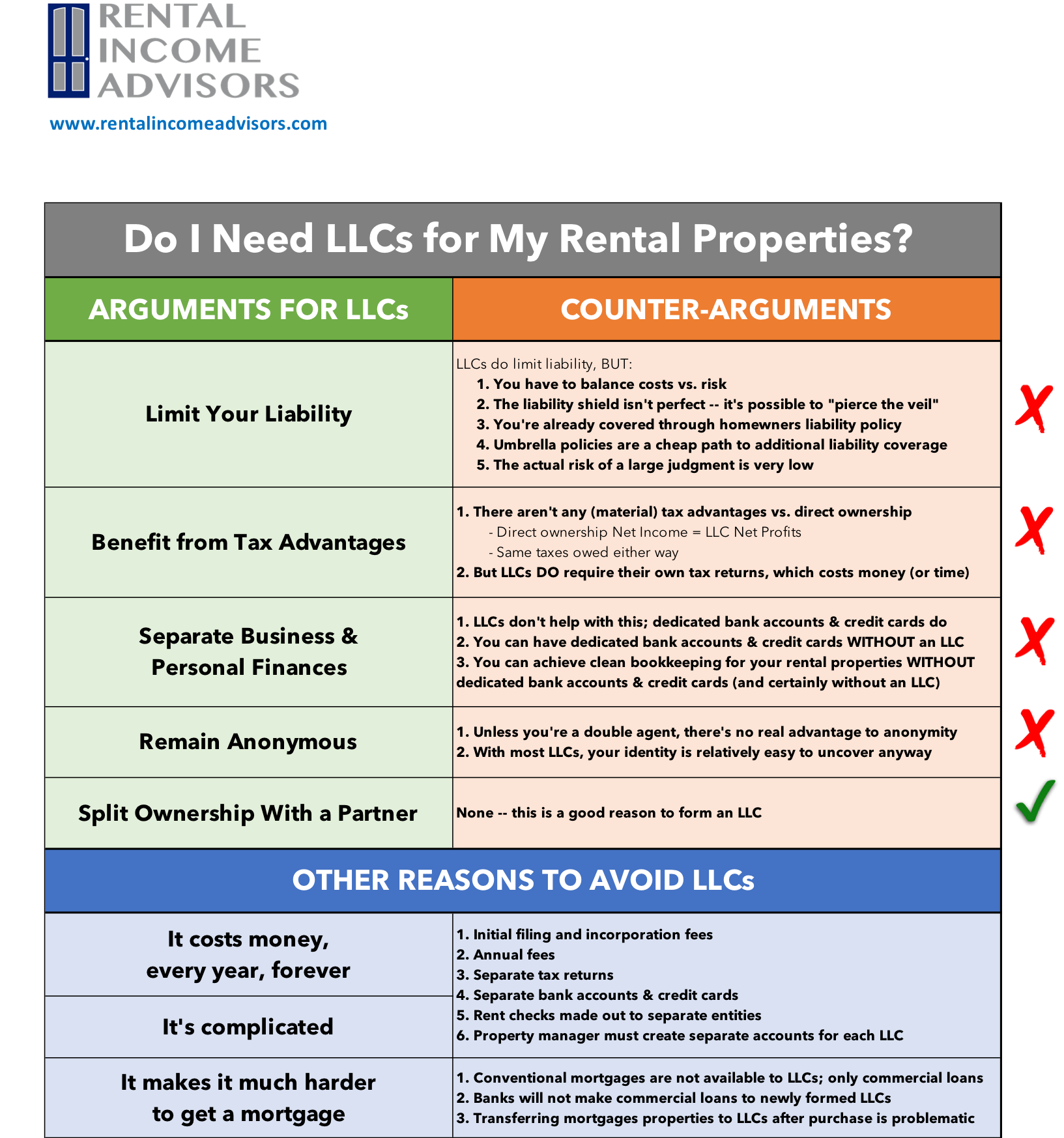

Even with the above advantages to using an LLC for single family rental properties no solution is completely perfect. Holding a rental property under an LLC may help to protect the personal assets of an investor in the event of a lawsuit. If rental properties are part of your investment portfolio then one of your basic.

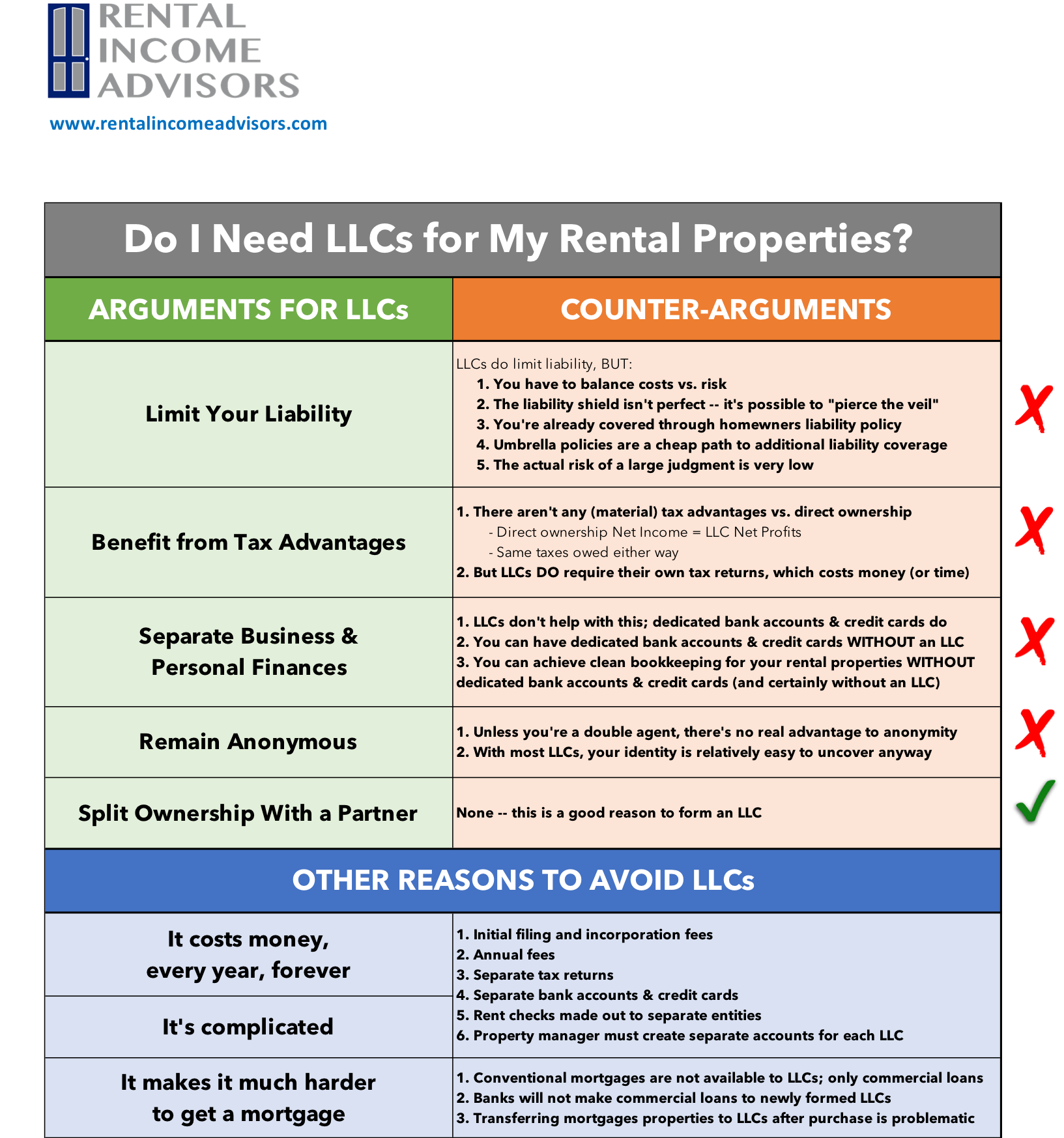

Here are the three potential drawbacks of this solution. Forming an LLC will help to protect your personal assets. They cite things such as pass-through taxation avoiding double-taxation simpler record-keeping and filing rules and so on.

The owner of an LLC Limited Liability Company is a member of that company and there is no minimum number of members required to form an LLC. While there are some benefits to buying a rental property through an LLC there are also some drawbacks. Ad Our Business Specialists Help You Incorporate Your Business.

While there arent always specific tax advantages for landlords its worth noting that there arent any disadvantages either. These costs are. It reduces your liability risk effectively separates your assets and has the tax benefit of pass-through taxation.

Greater flexibility ie. Limited Liability Form An LLC Benefits Of An LLC more. Other business ownership structures such as a corporation or partnership.

The aforementioned benefits come at a cost. Benefits of an LLC for Rental Properties. Depending on your specific situation and unique circumstances the following may be considered pros for making the decision to form an LLC.

An LLC can have one member or an unlimited number of members in a. Ad We Researched It For You. One of the main reasons that rental property owners decide to create an LLC is to limit personal liability.

Here are a few of the disadvantages of creating an LLC for rental property. There are various fees involved with setting up and maintaining an LLC which will vary by state. There are many advantages to establishing an LLC for your rental properties.

LLCs do cost money. Protection from liabilities. THE ADVANTAGES AND DISADVANTAGES TO.

Pros of an LLC for rental property. Instead of selling the property and asking tenants to re-sign leases with the new owner you can sell the LLC to a new owner while guaranteeing immediate occupancy. List of the Pros of Using an LLC for a Rental Property.

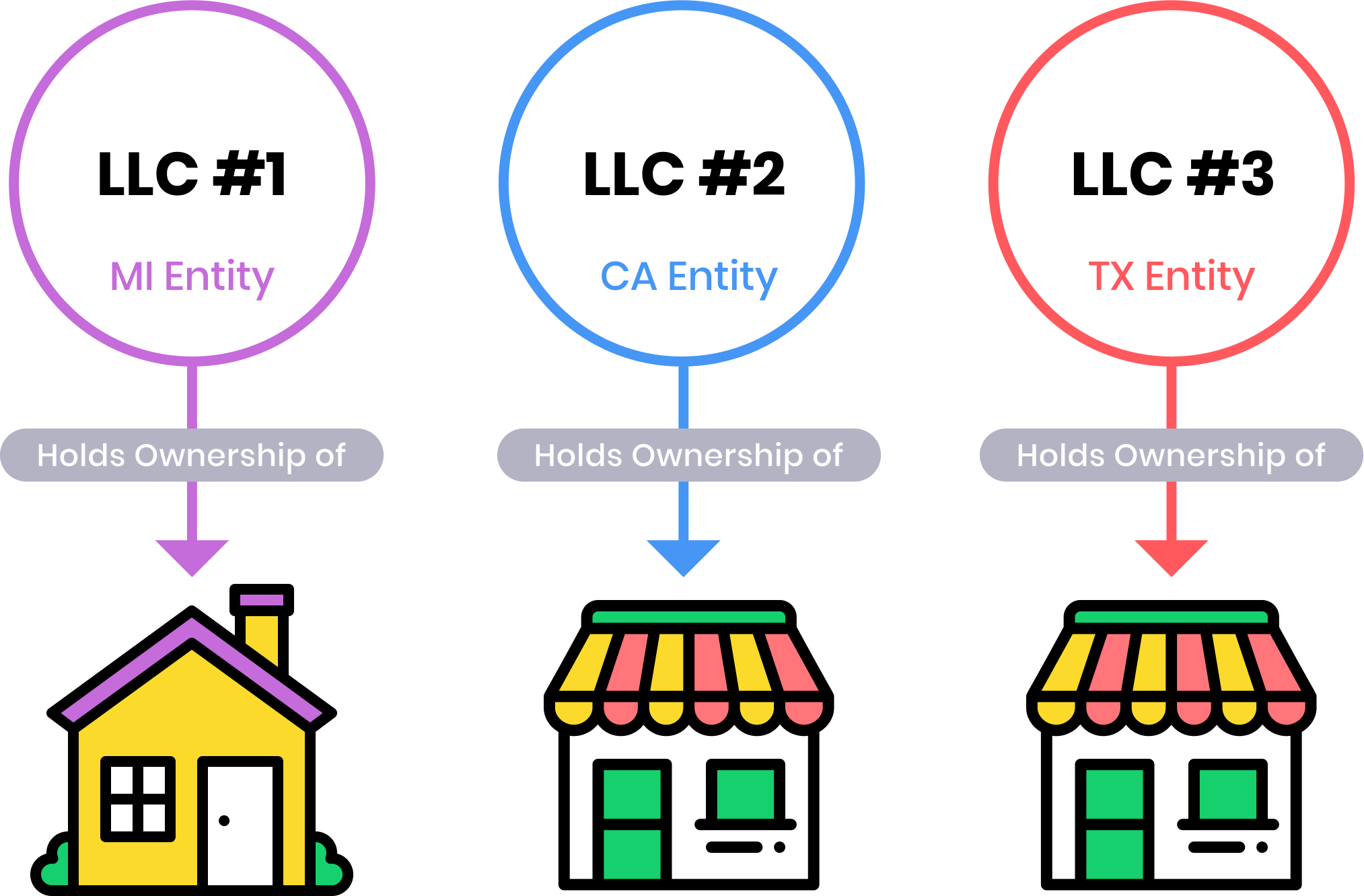

One of the disadvantages of using an LLC for a real estate rental business is the cost. Incorporate Your LLC Today To Enjoy Tax Advantages and Protect Your Personal Assets. Most discussions of the tax advantages of an LLC for your rental properties are quite misleading because they tell you why an LLC is advantageous vs.

Youll list the LLC as the property owner. Since you can depreciate your property you can artificially reduce the income that it. Potential to deduct mortgage interest and rental income.

Utilizing LLCs can impact your financing. Using a limited liability company to protect your rental properties has many advantages but a few disadvantages too. Single or multiple members allowed.

Cheaper state registration fees. The supposed tax advantages of rental properties are well-publicized. Distribution of profits and transferring interest rights.

For anything thats a claim against a propertylike Hey I slipped and fellan LLC is an entity that can stand between you and that. Liability insurance products have. Whoever makes the claim will come after the LLC not you personally.

Three Cons of Using an LLC for Single Family Rental Properties. There are tax advantages available to the LLC format. Ad Compare the Best LLC Formation Services and Make Your Dream A Reality.

You Dont Have to Spend a Fortune to File Up an LLC. Purchasing a rental property using an LLC has the advantage of facilitating a sale of the rental property without disturbing the tenants. Forming an LLC means you can avoid double taxation and it may allow you to reduce self-employment taxes if they are applicable in your situation.

It Costs Money to Register an LLC for Single Family Rental Properties. If you decide to create an LLC for your rental property make sure you update your rental leases.

Should You Create An Llc For Rental Property Pros And Cons New Silver

Llc In Nyc Real Estate Pros And Cons Nestapple New York

Llc In Nyc Real Estate Pros And Cons Nestapple New York

Llc In Nyc Real Estate Pros And Cons Nestapple New York

Should You Put Rental Properties In An Llc White Coat Investor

Benefits Of Buying A Rental Property Through An Llc Avail

20 Pros And Cons Of Creating An Llc For Your Rental Property

Should You Form An Llc For Rental Property 2022 Bungalow

Llc For Rental Property Pros Cons Explained Simplifyllc

12 Reasons To Use An Llc For Rental Property Under 30 Wealth

Llc For Rental Property Pros Cons Explained Simplifyllc

Should You Put Your Rental Property In An Llc Truic

Llc For Rental Property What Should Real Estate Investors Do

Llc For Rental Property Pros Cons Explained Simplifyllc

20 Pros And Cons Of Creating An Llc For Your Rental Property

Should I Transfer The Title On My Rental Property To An Llc

Why You Probably Don T Need An Llc For Your Rental Properties Rental Income Advisors